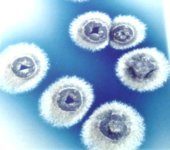

A paper was recently published in Nature Communications (https://www.nature.com/articles/s41467-019-08438-0) show the results of the discovery of potentially new antibiotics from Streptomyces living in insects. With antibiotic resistance as a major global crisis and very few new antibiotics coming to market, this is an important discovery. Streptomyces isolated from insects inhibited antimicrobial-resistant pathogens more than isolates from soil and can be the source of new promising antibiotics. They are especially effective against gram-negative bacteria and fungi. Cyphomycin is an example of new chemistry from this innovative source. This new source for antimicrobial compounds can invigorate the stagnant antimicrobial pipeline. The new compound has low toxicity to animals.

ruth

Host microbiomes are feasible sources for drug discovery. Here, using large-scale isolations, bioactivity assays and omics, the authors uncover the antimicrobial potential of insect-associated Streptomyces and identify a compound, cyphomycin, active against multidrug-resistant fungal pathogens.

ruth

{“post_id”:5534,”post_type”:”post”,”shortcode”:”peepso_postnotify”,”permalink”:”https:\/\/ask-bioexpert.com\/blog-post\/the-fda-issued-a-report-on-findings-from-the-investigation-of-the-california-linked-romaine-lettuce-outbreak-of-e-coli-o157h7-in-november-2018\/”}

ruth

The FDA is alerting consumers of potential Salmonella Tennessee contamination of Soom Foods Chocolate Sweet Tahini Halva Spread. This product is individually packaged in 1 oz. (30 ML) pouches in purple laminated paper packets with a tear-away tab on one end. In response to an investigation of the Salmonella concord outbreak, the FDA analyzed retained product samples of Soom Foods Chocolate Sweet Tahini Halva Spread. The analysis of the samples found that the product contained Salmonella Tennessee. While Soom Foods was notified of the Chocolate Sweet Tahini Halva Spread product testing positive for Salmonella Tennessee result, it has not yet acted by recalling the product. Currently, the FDA is not aware of any illnesses related to consumption of these individually-packed halva spread. @ https://www.fda.gov/Food/RecallsOutbreaksEmergencies/SafetyAlertsAdvisories/ucm631190.htm

https://www.fda.gov/Food/RecallsOutbreaksEmergencies/SafetyAlertsAdvisories/ucm631190.htm

ruth

The Brazilian food processor BRF SA (the world’s largest poultry exporter) recalled almost 500 tons of fresh chicken products on Wednesday due to salmonella enteritidis contamination concerns. 164.7 metric tons of fresh chicken were pulled from the Brazilian domestic market and another 299.6 tons destined for international markets (Japan, China, Kuwait, Ghana, Bahrain, Gambia, Oman, Angola, and Cuba). Testing in the company QC lab revealed the potential problem. Shares of the company fell as much as 2 percent in morning trading in São Paulo before trimming losses to 1.5 percent. The company said it has deployed a group of experts to investigate the origins of salmonella case, and it is applying a rigorous production control process at its Dourados plant to guarantee that the contamination was a single event and that it will not repeat. @ https://www.reuters.com/article/us-brf-recall/brazils-brf-recalls-chicken-export-products-over-salmonella-fears-idUSKCN1Q210V

Brazilian food processor BRF SA recalled almost 500 tonnes of fresh chicken prod…